Acquiring new customers means ignoring the problem.

The markets for insurance and banking services, energy, telecommunications and entertainment streaming services are lacking high customer churns. A separate industry has emerged, which not only supports consumers with managing their contracts via app or Internet platform, but also helps them to find cheaper contracts including a termination service. Saving money by switching providers” is highly present in media, consumer programs and TV commercials. Many comparison portals suggest market transparency and offer a streamlined path to the next best contract.

But wait? The number of lost customers, contracts or policies with an average annual churn rate of around 5% can be easily resolved by acquiring new customers? Such an approach ignores the negative financial impact of contract terminations. They not only result in the loss of income and earnings. The effective cancellation volume is decisive! With a comparatively low annual lapse rate of 2.5% for life insurance policies, the annual lapse volume is not around 2.5 billion euros in lost premium income for one year, but a staggering 13.8 billion – annually! In order to compensate for the financial damage by acquiring new customers, it would take a multiple of the lost annual sales volume.

Companies should prevent customer churns from the beginning

In many companies, contract terminations are handled as soon as they receive the termination. In the next step inventory management comes into play: Employees contact customers asking them for their termination reasons and offering cheaper product alternatives. It is remarkable that especially in telecommunications or streaming subscription services, this type of customer recovery is an integral part of portfolio management.

The situation is different in the insurance sector: Q_PERIOR’s cancellation analysis of German insurance companies has shown that 99% of policy holders who have canceled an insurance policy stick with this decision.

Understanding contract terminations as the end of a negative customer journey

A popular narrative to explain contract terminations is the reference to “one’s own unattractive price positioning in the market”. In fact, there are markets where providers have made themselves dependent on price comparison services by communicating exclusively on the price offered (telecommunications and energy are examples). And of course there is the customer group of price-optimizing “hop-on hop-off customers” – but this is only a comparatively small customer segment.

In fact, a customers’ decisions to switch to another provider comes rarely “out of the blue”. Considering to terminate a contract usually arises in the context of frustrating customer experiences.

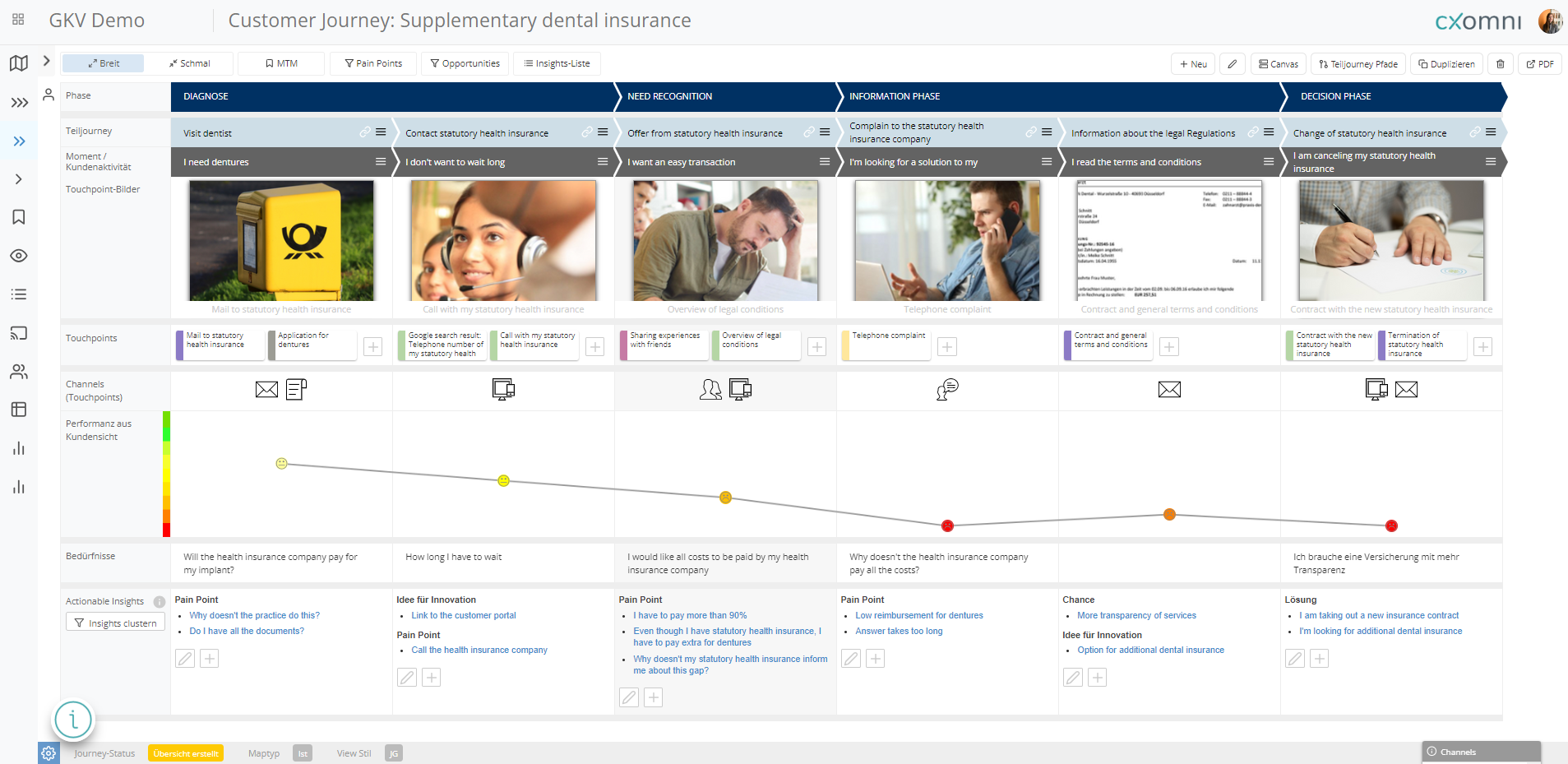

Here is an example of a negative customer journey visualized in cxomni. It shows how a frustrating customer experience can be the cause for switching to statutory health insurance. This example could easily be applied to other service providers.

Customer Journey Analytics: value-add in churn risk identification and management

In many companies, the identification of churn risks is treated carelessly. In addition to the aforementioned misconception that contract terminations can be offset by winning new customers and that price positioning is decisive for customer loyalty, the main reason is that the conventional models for identifying termination risks are generally not action-oriented: What happens if the analytics department shares a list of several thousand customers with a churn probability of more than 50%? There are usually not enough resources to process all of these customers individually.

Q_PERIOR solves this operational dilemma for many companies by combining the classic approach of determining the customer-specific churn risk with customer journey analytics.

Conventional models attempt to predict contract terminations in the past. In addition to sociodemographic customer data, a robust predictive model requires data on the historical development of the contractual relationship. This data is then used to model past terminations including their causes. Such a lapse prediction model (for the past) is then applied to the current in-force portfolio. The probability of churn can then be displayed as a score or percentage for each individual customer and added to the customer profile as additional attribute.

Such a complementary Customer Journey Analytics model can be used to derive a customer-specific frustration score. This primarily requires data from customer interactions. For example, a call to customer service about an outstanding claim reimbursement is not an expression of frustration, but the third call on the same topic with the same request within a week is. So creating rules to score customer interactions for frustration potential requires more complex statistical modeling to validate and calibrate on an ongoing basis.

The Q_PERIOR Churn Risk Management Framework

- Prioritized, Customer-Specific Retention Management

The focus should be on customers with an individually high (and low) churn risk, who are likely to be frustrated based on the current interaction. Such customers require prioritized, customer-specific retention management. - Generalize Retention Campaigns

Customers with an individual high churn risk, but without a current high level of frustration, should be treated with general retention campaigns, whereby we do not recommend “one-size-fits-all” campaigns, but rather differentiation based on other characteristics such as customer value, demographics, etc., and the development of segment-specific measures. - Service and Relationship Management

If the customer-specific churn risk is low but the current frustration score is high, it is advisable to reduce frustration. However, service and relationship management is more important here than specialized retention management. - No Need for Retention Management

There is no need for general retention management for policyholders with a low general lapse risk and a low level of frustration.

About cxomni

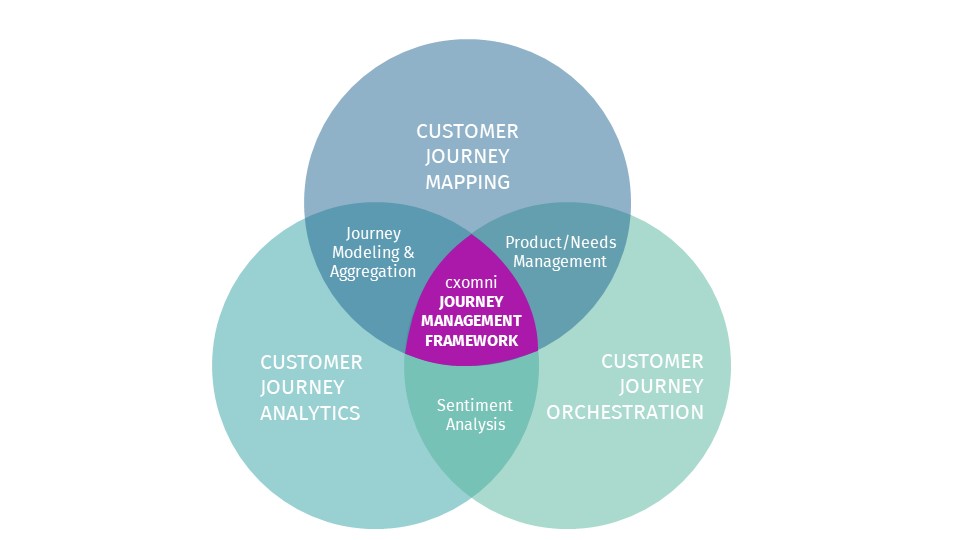

With cxomni, customer-centric companies can collaboratively identify relevant customer insights, visualize them in the context of the journey and orchestrate corresponding needs and requirements for the responsible stakeholders.

With cxomni’s comprehensive SaaS tool suite, journeys can be designed, mapped and managed and products and services can be developed and optimized according to CX and UX.

About the author

Marcus Neureiter is Managing Consultant for Customer Excellence/Insurance at Q_PERIOR. He has held various management positions in the areas of Customer Intelligence, Customer Experience Management and Process/Journey Optimization, specializing in Customer Management. In addition to his technical expertise, he has extensive experience in program and transformation management.

Q_PERIOR’s mission is to deliver top performance for its clients. The focus is on the integration of business and IT. As a management consultancy, Q_PERIOR is service- and solution-oriented and impresses with a cross-industry expertise. The results are new, creative approaches for innovative business models.